So, your sales forecast isn’t as accurate as you’d like it to be?

Join the club.

Kidding aside, you’re not alone. During the past two years, I’ve seen at least three studies that found most sales leaders do not have high confidence in their forecast.

Are forecasting methods to blame? Maybe. Some methods are outright terrible—for example, relying on sales reps’ opinions. (Seriously, have you ever met an account executive who was over optimistic on the number of deals they expected to close?)

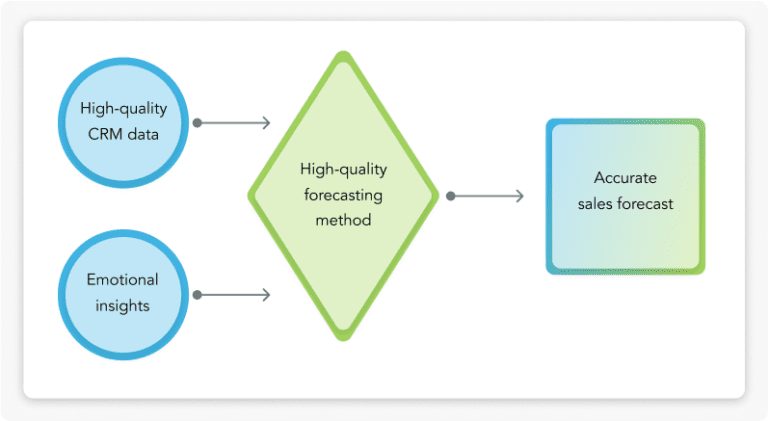

Methods like sales cycle forecasting and pipeline forecasting are less biased and more accurate. But all forecasting methods require accurate CRM data, and high-quality data is in short supply.

In fact, LinkedIn’s 2022 State of Sales Report found that 41% of sellers are stuck dealing with inaccurate, out-of-date CRM data. Bad data is a natural consequence of asking reps to enter sales activity data into the CRM manually.

Sellers’ biggest data challenges

Sales orgs that use a revenue intelligence tool to automate data capture have a leg up over those that don’t in terms of data quality. But there’s still a missing piece of the forecasting puzzle. And it’s a big missing piece.

Sales forecasts don’t factor in buyer emotions.

Harvard professor Gerald Zaltman says that 95% of purchasing decisions are subconscious. This means purchases are primarily driven by feelings. Every interaction, from first meeting to closed won, influences customer sentiment and engagement. Emotional factors at play within a sales meeting include:

The positive or negative emotion a customer displays

EngagementThe level of compromise and attention a customer displays.

The higher the sentiment and engagement on an account, the more likely the deal is to close.

Despite the obvious relationship between buyer emotions and sales outcomes, most sales orgs haven’t incorporated buyer emotions into their forecast. Why not? Because they haven’t had a reliable method for measuring customer sentiment and engagement.

Until now.

Introducing the 2 x 2 customer sentiment and engagement matrix

- On the Y axis is customer sentiment: positive or negative

- On the X axis is customer engagement: high or low

Sentiment and engagement are the building blocks of your customer pulse. Collectively, we call these emotional insights.

Whereas CRM data looks in the rearview mirror, emotional insights help you get an accurate pulse on the current state of deals. Both inputs are needed for the most accurate sales forecast.

I’m confident that one day organizations will see the value of having CRM fields for sentiment and engagement. It’s one of those things where once you see it you can’t unsee it.

Download the 2 x 2 template and try it out.

If you’re not a Q For Sales customer, you can still get value from mapping customer sentiment and engagement.

This 2 x 2 template includes 10 questions to help you determine the sentiment and engagement of each account. This exercise is so simple, you could even do it on a napkin.

Note: Completing the 2 x 2 by hand will provide a less accurate state of the union on deals (similar to entering sales activity data manually vs. automatically capturing sales activity data). By contrast, Q for Sales has analyzed thousands of hours of sales conversations, and uses multimodal AI to determine customer sentiment and engagement.

)